FAQs

Here are some of our Frequently Asked Questions. If you have other questions that you still don’t see an answer for, leave us a message in the contact form below.

here are some of our frequently asked questions. if you have other questions that you still don’t see an answer for, leave us a message in the contact form below.

why should everwealth manage my money?

When EVERWEALTH® was founded more than 20 years ago, we set out to change the way traditional wealth management was performed. While most of the brokers who claim to be wealth managers simply recommend investment products and leave it at that, we take a holistic approach to your wealth by creating a wealth management plan that encompasses everything you want to achieve, and we then utilize our Process to ensure it stays on track. Utilizing our planning tools, we’ve bridged the gap between technology and human interaction, while still focusing on building lasting relationships. After all, we’re still a family-operated business at heart, and we tend to keep it that way.

Where are my accounts held?

For our private wealth management clients, we primarly custody accounts with TD Ameritrade Institutional. We periodically analyze the custodial marketplace to see if there are better fits for these types of accounts, and make changes when we deem them to be prudent. For our Retirement Plans, it becomes a little more complex, and we analyze each plan according to the different aspects of the plan design to determine where the plan should be held.

How can i view my accounts?

Once your accounts are established, your account custodian will provide you with a point-of-entry where you can login and view your accounts. As part of our Process, we make it a priority to ensure that you are comfortable with being able to access your account online.

What are your fees?

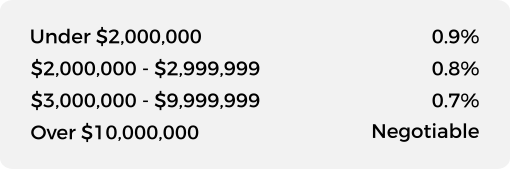

We receive one simple fee based upon a percentage of the assets that we manage. In some specific cases, we will negotiate our fees, but primarily for our private wealth management clients, our fees typically follow the following schedule…

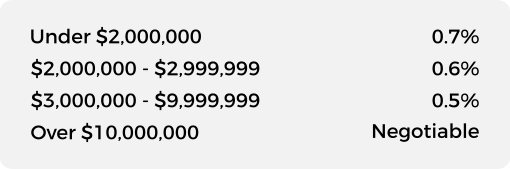

For our Retirement Plan Consulting Services, our fees typically follow the following schedule…

How are fees typically charged by a traditional broker?

Traditionally, brokers have recommended investment instruments that pay them commissions, being incentivized by selling specific products for their clients that may actually not be what’s best for them. As part of this, traditional brokers have provided service under a standard of oversight known as suitability, meaning that the recommendations they make only need to meet the requirements of being suitable for a client and not necessarily in their best interests.

At EVERWEALTH®, we are bound by what’s known as the fiduciary standard of oversight, obligating us to go beyond the traditional standard and act solely in our clients’ best interests. We are not incentivized to recommend one investment over another (other than it being in your best interests) and we receive nothing from any investment company or firm. While some – and hopefully most – of the traditional brokers have good intentions, it is still something to consider when basing your decision on working with a true wealth management firm.

How quickly can i get access to money if i need it?

For our private wealth management clients, we primarily utilize highly liquid funds, meaning that money can typically be made available within 1-3 business days.

Still need help? Ask your question here!

wm = ic + ap + rm

wealth management investment consulting

advanced planning

relationship management

Wealth Management Advisors, LLC DBA Everwealth®, located in Tulsa, OK, is a Registered Investment Adviser under the Oklahoma Uniform Securities Act of 2004. We provide wealth management and financial planning services. Past performance is not necessarily indicative of future results. Investing involves risk, including the possibility of financial loss. Insurance-related business is offered through Riddle Financial Group, LLC, a separate company from Wealth Management Advisors, LLC DBA Everwealth. Please see our Disclosure section for important information.