INVESTMENT REPORT CARD™

See how your investments and portfolio compare on an apples-to-apples basis.

When it comes to monitoring your Investment Portfolio, focusing solely on Investment Returns is not the complete picture. With our proprietary Investment Report Card™, we’ve created a Scoring System based upon factors and criteria that go beyond performance alone. This Scoring System is then used to render a Letter Grade and Status Report for each of your funds, allowing you to see how your investment funds compare relative to their Peer Group. We then aggregate your individual holdings on a dollar-weighted basis and analyze your entire Investment Portfolio, giving you an apples-to-apples comparison.

ADVANCED SCORING SYSTEM

With our Investment Report Card™, we have created unique formulas for each type of fund you have in your Portfolio. We then assess and categorize your investment funds into Peer Groups, allowing you to compare each respective fund to like-kind investment options. The Letter Grade and Score helps you easily identify which funds are more suitable than others, and which ones may need to be replaced.

ADVANCED SCORING SYSTEM

With our Investment Report Card™, we have created unique formulas for each type of fund you have in your Portfolio. We then assess and categorize your investment funds into Peer Groups, allowing you to compare each respective fund to like-kind investment options. The Letter Grade and Score helps you easily identify which funds are more suitable than others, and which ones may need to be replaced.

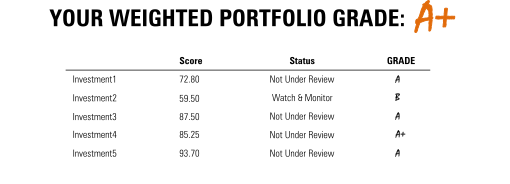

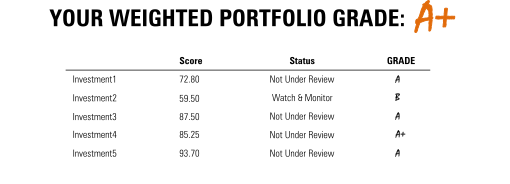

STATUS REPORTING

We factor and analyze the Letter Grade, Overall Score, and the Percentile Ranking to assess a fund’s Status Report. Depending on the outcomes, a fund is considered “Not Under Review”, “Watch & Monitor”, or “Under Review”.

STATUS REPORTING

We factor and analyze the Letter Grade, Overall Score, and the Percentile Ranking to assess a fund’s Status Report. Depending on the outcomes, a fund is considered “Not Under Review”, “Watch & Monitor”, or “Under Review”.

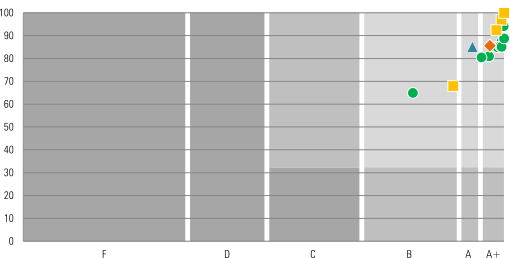

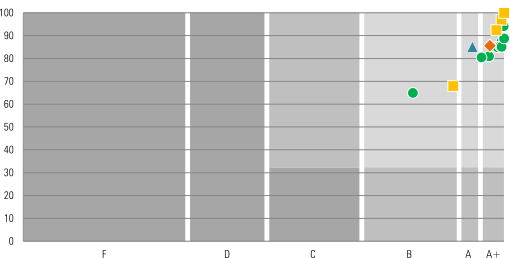

PORTFOLIO SCORING

Scoring the underlying funds in a Portfolio is great, but being able to grade your Portfolio as a whole is even better. We take your Portfolio on a dollar-weighted basis and analyze it against a Peer-Group Portfolio to see how it compares, both in terms of the Scoring Factor and on an actual dollar amount.

PORTFOLIO SCORING

Scoring the underlying funds in a Portfolio is great, but being able to grade your Portfolio as a whole is even better. We take your Portfolio on a dollar-weighted basis and analyze it against a Peer-Group Portfolio to see how it compares, both in terms of the Scoring Factor and on an actual dollar amount.

DOLLAR-BASED COMPARISONS

We take the analysis a step further by analyzing the amount you gained or lost vs. a Peer-Group Portfolio in terms of performance and fund expenses.

DOLLAR-BASED COMPARISONS

We take the analysis a step further by analyzing the amount you gained or lost vs. a Peer-Group Portfolio in terms of performance and fund expenses.

Learn More About our Other Wealth Tools

wm = ic + ap + rm

wealth management investment consulting

advanced planning

relationship management

Wealth Management Advisors, LLC DBA Everwealth®, located in Tulsa, OK, is a Registered Investment Adviser under the Oklahoma Uniform Securities Act of 2004. We provide wealth management and financial planning services. Past performance is not necessarily indicative of future results. Investing involves risk, including the possibility of financial loss. Insurance-related business is offered through Riddle Financial Group, LLC, a separate company from Wealth Management Advisors, LLC DBA Everwealth. Please see our Disclosure section for important information.