Alternative Reality

Diversification has been called the only free lunch in investing.

This idea is based on research showing that diversification, through a combination of assets like stocks and bonds, could reduce volatility without reducing expected return or increase expected return without increasing volatility compared to those individual assets alone. Many investors have taken notice, and today, highly diversified portfolios of global stocks and bonds are readily available to investors at a comparatively low cost. A global stock portfolio can hold thousands of stocks from over 40 countries around the world, and a global bond portfolio can be diversified across bonds issued by many different governments and companies and in many different currencies.

Some investors, in search of additional potential volatility reduction or return enhancement opportunities, may even try to extend the opportunity set beyond stocks and bonds to other assets, many of which are commonly referred to as “alternatives.” The types of offerings labeled as alternative today are wide and varied. Depending on who you talk with, this category can include, but is not limited to, different types of hedge fund strategies, private equity, commodities, and so on. These investments are often marketed as having greater return potential than traditional stocks or bonds or low correlations with other asset classes.

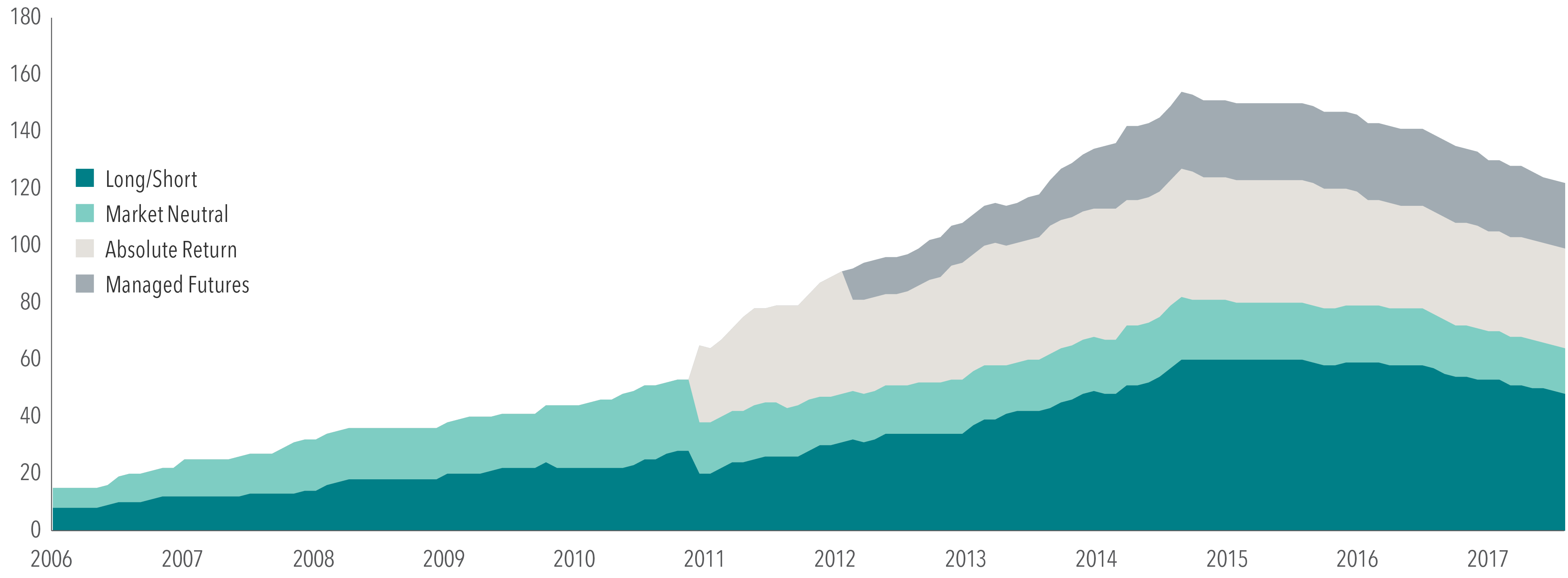

In recent years, “liquid alternatives” have increased in popularity considerably. This sub-category of alternatives consists of mutual funds that may start from the same building blocks as the global stock and bond market but then select, weight, and even short securities[1] in an attempt to deliver positive returns that differ from the stock and bond markets. Exhibit 1 shows how the growth in several popular classifications of liquid alternative mutual funds in the US has ballooned over the past several years.

EXHIBIT 1. Number of Liquid Alternative Mutual Funds In the US, June 2006-December 2017 [a]

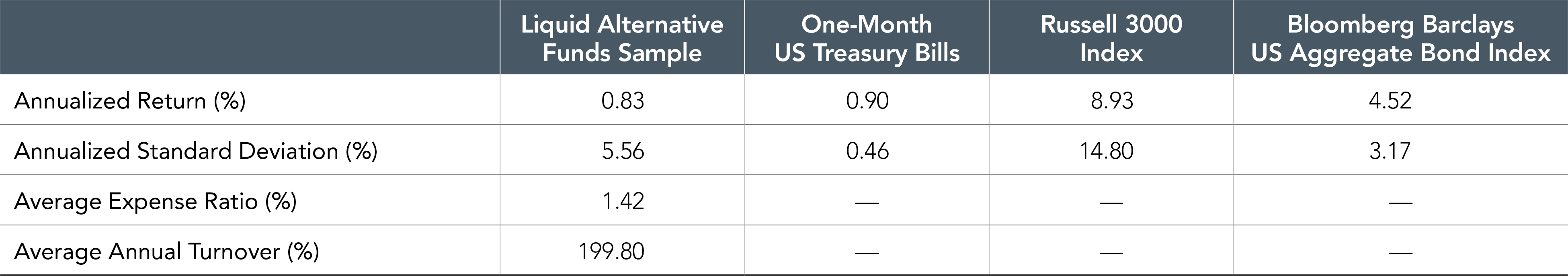

The growth in this category of funds is somewhat remarkable given their poor historical performance over the preceding decade. Exhibit 2 illustrates that the annualized return for such strategies over the last decade has tended to be underwhelming when compared to less complicated approaches such as a simple stock or bond index. The return of this category has even failed to keep pace with the most conservative of investments. For example, the average annualized return for these products over the period measured was less than the return of T-bills but with significantly more volatility.

EXHIBIT 2. Performance and Characteristics of Liquid Alternative Funds in the US vs. Traditional Stock and Bond Indices, June 2006-December 2017 [b]

While expected returns from such strategies are unknown, the costs and turnover associated with them are easily observable. The average expense ratio of such products tends to be significantly higher than a long-only stock or bond approach. These high costs by themselves may pose a significant barrier to such strategies delivering their intended results to investors. Combine this with the high turnover many of these strategies may generate and it is not challenging to understand possible reasons for their poor performance compared to more traditional stock and bond indices.

This data by itself, though, does not warrant a wholesale condemnation of evaluating assets beyond stocks or bonds for inclusion in a portfolio. The conclusion here is simply that, given the ready availability of low cost and transparent stock and bond portfolios, the intended benefits of some alternative strategies may not be worth the added complexity and costs.

CONCLUSION

When confronted with choices about whether to add additional types of assets or strategies to a portfolio for diversification beyond stocks, bonds, and cash it may help to ask three simple questions.

- What is this alternative getting me that is not already in my portfolio?

- If it is not in my portfolio, can I reasonably expect that including it will increase expected returns or reduce expected volatility?

- Is there an efficient and cost-effective way to get exposure to this alternative asset class or strategy?

If investors are left with doubts about any of these three questions it may be wise to use caution before proceeding. A good advisor can help investors answer these questions and ultimately decide if a given strategy is right for them.

ALTERNATIVE STRATEGY DEFINITIONS

Absolute Return: Funds that aim for positive return in all market conditions. The funds are not benchmarked against a traditional long-only market index but rather have the aim of outperforming a cash or risk-free benchmark.

Equity Market Neutral: Funds that employ portfolio strategies that generate consistent returns in both up and down markets by selecting positions with a total net market exposure of zero.

Long/Short Equity: Funds that employ portfolio strategies that combine long holdings of equities with short sales of equity, equity options, or equity index options. The fund may be either net long or net short depending on the portfolio manager’s view of the market.

Managed Futures: Funds that invest primarily in a basket of futures contracts with the aim of reduced volatility and positive returns in any market environment. Investment strategies are based on proprietary trading strategies that include the ability to go long and/or short.

Category descriptions are based on Lipper Class Codes provided in the CRSP Survivorship bias-free Mutual Fund Database.

[1]. A short position is the sale of a borrowed security. Short positions benefit if the borrowed security falls in value. [a]. Sample includes absolute return, long/short equity, managed futures, and market neutral equity mutual funds from the CSRP Mutual Fund Database after they have reached $50 million in AUM and have at least 36 months of return history. Multiple share classes are aggregated to the fund level. [c]. Past performance is no guarantee of future results. Results could vary from different time periods and if the liquid alternative funds universe, calculated by Dimensional using CSRP data, differed. This is for illustrative purposes only and doesn’t represent and specific investment product or account. Indices cannot be invested into directly and do not reflect fees and expenses associated with an actual investment. The fund returns included in the liquid alternative funds average are net of expenses. Please see fund’ annual report and prospectus for additional information on a specific portfolio’s turnover and the expenses it incurs. Liquid Alternative Funds Sample includes absolute return, long/short equity, managed futures, and market neutral equity mutual funds from the CRSP Mutual Fund Database after they have reached $50 million in AUM and have at least 36 months of return history. Dimensional calculated annualized return, annualized standard deviation, expense ratio, and annual turnover as an asset-weighted average of the Liquid Alternative Funds Sample. It is not possible to invest directly in an index. Past performance is not a guarantee of future results. Source of one-month US Treasury bills: © 2018 Morningstar. Former source of one-month US Treasury bills: Stocks, Bonds, Bills, and Inflation, Chicago: Ibbotson And Sinquefield, 1986. Bloomberg Barclays data provided by Bloomberg Finance L.P. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to Russell Indexes. Standard deviation is a measure of the variation of a set of data points. Standard deviations are often used to quantify the historical return volatility of a security or a portfolio. Turnover measures the portion of securities in a portfolio that are bought and sold over a period of time. Data Source: Dimensional Fund Advisors LP. Diversification does not eliminate the risk of market loss. There is no guarantee an investing strategy will be successful. Investment risks include loss of principal and fluctuating value. Sector-specific investments can also increase these risks. Environmental and social screens may limit investment opportunities. Small and micro cap securities are subject to greater volatility than those in other asset categories. All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their financial advisor prior to making any investment decision.

wm = ic + ap + rm

wealth management investment consulting

advanced planning

relationship management

Wealth Management Advisors, LLC DBA Everwealth®, located in Tulsa, OK, is a Registered Investment Adviser under the Oklahoma Uniform Securities Act of 2004. We provide wealth management and financial planning services. Past performance is not necessarily indicative of future results. Investing involves risk, including the possibility of financial loss. Insurance-related business is offered through Riddle Financial Group, LLC, a separate company from Wealth Management Advisors, LLC DBA Everwealth. Please see our Disclosure section for important information.