Doing Well & Doing Good?

Growing interest in the impact of fossil fuels on the global

climate may spark questions about whether individuals can integrate their values around sustainability with their investment goals and, if so, how.

As citizens, individuals can express their political preferences around sustainability through the ballot box. As investors, they also can express their preferences through participation in global capital markets. One key question these investors face is how to do this without compromising their desired investment outcomes. For instance, how can they reduce their portfolio’s environmental footprint while maintaining sound investment principles and achieving their investment objectives?

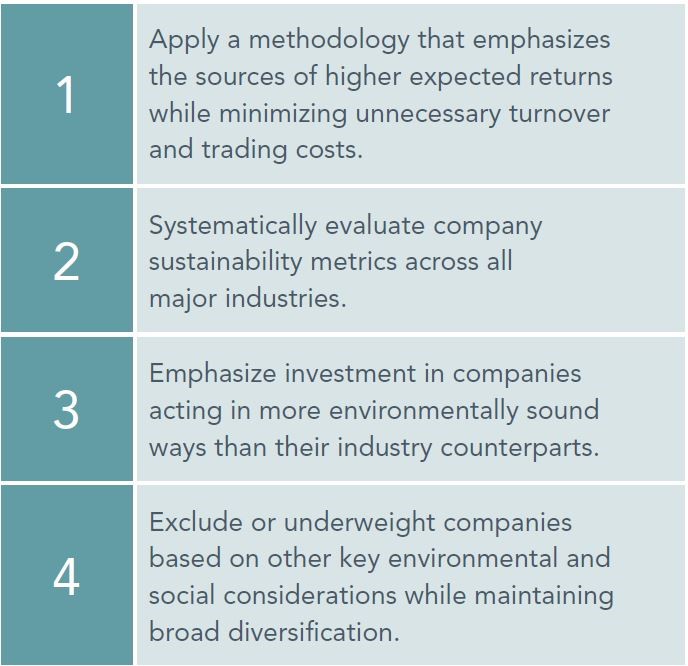

Sustainability preferences are not generally restricted to greenhouse gas emissions. Many investors may also have concerns about land use and biodiversity, toxic spills and releases, operational waste, and water management, among other issues. Thus, it is a challenge to achieve the dual goal of efficiently considering sustainability preferences while building investment solutions that help meet investors’ financial goals. One way to approach this challenge is to focus first on developing an investment methodology that emphasizes what research indicates are reliable sources of higher expected returns while also aiming to minimize unnecessary turnover and trading costs. For instance, this may mean starting with a broad universe of stocks ranging from very large companies to very small companies, and then systematically pursuing higher expected returns by increasing the weights of those securities with smaller market capitalizations, lower relative prices, and higher profitability.[1]

Next, investors can evaluate those companies being considered for investment using a focused set of environmental issues that reflect their primary concerns. By using a holistic scoring system, rather than a completely binary “in” or “out” screening process, investors may be able to preserve diversification while recognizing those companies with positive environmental profiles. This involves looking at companies across the entirety of a portfolio and within individual sectors with the goal of incorporating sustainability preferences while also maintaining the characteristics of the original strategy. For example, if one is trying to reduce a portfolio’s greenhouse gas emissions and potential emissions from fossil fuel reserves, the worst offenders across all industries may first be de-emphasized or excluded from the portfolio altogether. An across-industry comparison of this nature provides an efficient way to significantly reduce the aggregate greenhouse gas emissions per unit of revenue produced by companies within a portfolio with a minimal reduction in diversification. Next, companies may also be rated on sustainability considerations within each industry. This added level of scrutiny is recognition that, in the real economy, capital markets and the supply chain are highly interconnected. For example, a retail company may consume electricity from a utility company and transportation services from a trucking company, both of which are consumers of fuel from an energy company. Comparing companies within sectors recognizes this ‘interconnectedness’ and can be used to overweight the most sustainable companies within a given industry. This could include retail companies that improve the energy efficiency of their facilities, utilities that produce electricity using solar or wind power, trucking companies that improve the fuel efficiency of their fleets or use alternative-fuel vehicles, or energy companies that increase efficiency, reduce waste, and improve their overall environmental footprint. On the other hand, companies with poor environmental sustainability ratings relative to industry peers may receive a lesser weight or may be excluded.

A Suggested Approach to Sustainability Investing

Using such a combination of company selection and weighting may allow for substantial reduction in exposure to greenhouse gas emissions and potential emissions from fossil fuel reserves—important goals for many investors—while providing a robust investment strategy that is broadly diversified and focused on the drivers of expected returns.

CONCLUSION

The key takeaway for investors is that investing well and incorporating values around sustainability need not be mutually exclusive. By starting with a robust investment framework, then overlaying the considerations that represent the views of sustainability-minded investors, this allows for a cost-effective approach that provides investors the ability to pursue their sustainability goals without compromising on sound investment principles or accepting lower expected returns.

[1]. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book equity. Data Source: Dimensional Fund Advisors LP. Diversification does not eliminate the risk of market loss. There is no guarantee an investing strategy will be successful. Investment risks include loss of principal and fluctuating value. Sector-specific investments can also increase these risks. Environmental and social screens may limit investment opportunities. Small and micro cap securities are subject to greater volatility than those in other asset categories. All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their financial advisor prior to making any investment decision.

wm = ic + ap + rm

wealth management investment consulting

advanced planning

relationship management

Wealth Management Advisors, LLC DBA Everwealth®, located in Tulsa, OK, is a Registered Investment Adviser under the Oklahoma Uniform Securities Act of 2004. We provide wealth management and financial planning services. Past performance is not necessarily indicative of future results. Investing involves risk, including the possibility of financial loss. Insurance-related business is offered through Riddle Financial Group, LLC, a separate company from Wealth Management Advisors, LLC DBA Everwealth. Please see our Disclosure section for important information.