PORTFOLIO IMPLEMENTATION ANALYSIS

A customized portfolio allocation analysis that pinpoints the exact investments for each of your accounts, optimizing your expected tax efficiency and future trading.

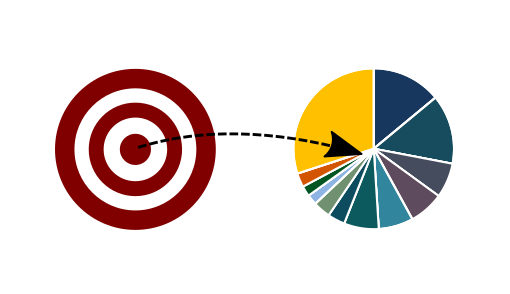

When implementing a Target Asset Allocation for your Wealth Management Plan, many factors should contribute in determining an efficient method for executing the transactions, including the potential tax exposure and transaction costs. As a result, we created our Portfolio Implementation Analysis to help determine the proper way to engage your initial implementation, giving you a unique and customized investment portfolio that considers all of your accounts and the underlying asset classes.

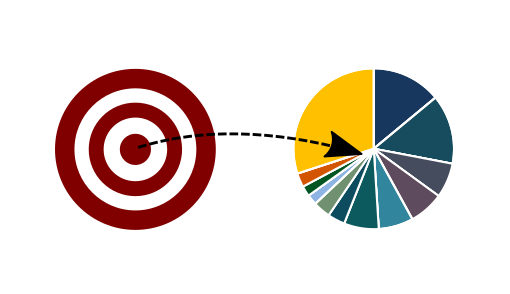

Let’s assume that we have determined a proper target investment strategy for your wealth management plan that considers your Wealth Goals and aligns to your Risk Capacity.

Let’s also assume that we need to implement your investment strategy across multiple accounts, each with potentially different tax registrations and varying amounts.

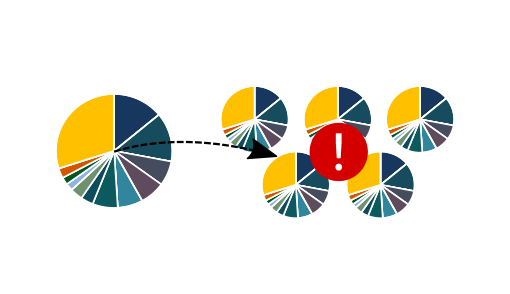

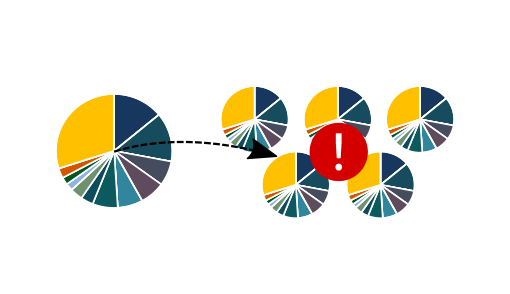

Traditionally, each of your accounts would mirror each other and the target, leaving the same investments in each of your accounts. This is inefficient for both expected taxes and transactions.

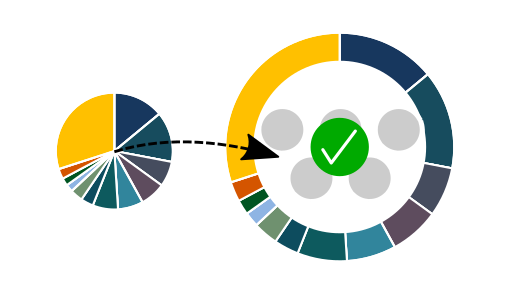

Instead, we look at balancing all of your accounts to the target investment strategy as a whole, determining the underlying asset classes that make the most sense for each particular account and investment.

Let’s assume that we have determined a proper target investment strategy for your wealth management plan that considers your Wealth Goals and aligns to your Risk Capacity.

Let’s also assume that we need to implement your investment strategy across multiple accounts, each with potentially different tax registrations and varying amounts.

Traditionally, each of your accounts would mirror each other and the target, leaving the same investments in each of your accounts. This is inefficient for both expected taxes and transactions.

Instead, we look at balancing all of your accounts to the target investment strategy as a whole, determining the underlying asset classes that make the most sense for each particular account and investment.

HOW DO WE DO IT?

We’ve developed a full-fledged implementation process out of what we consider Smart-Location Investing™

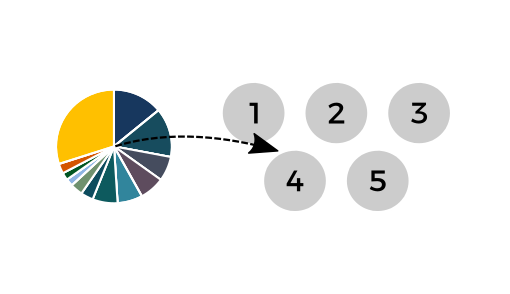

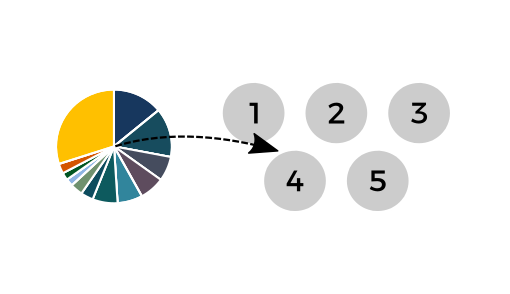

1.

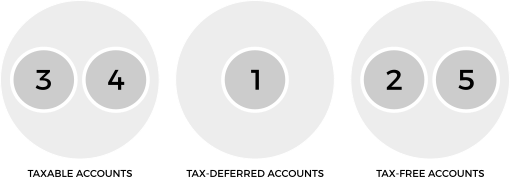

We first analyze the tax registrations of each of your investment accounts and group them into three categories, ranked in order of market value.

1.

We first analyze the tax registrations of each of your investment accounts and group them into three categories, ranked in order of market value.

2.

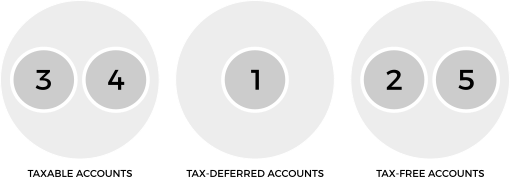

We then dissect the underlying target asset classes and establish specific priority levels for each one, based upon their expected taxation, future expected return, and target weight.

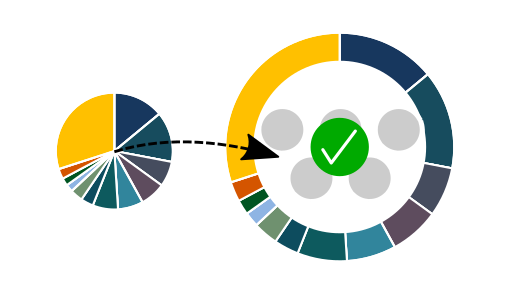

3.

We then optimize your portfolio by determining the appropriate asset classes for each category of accounts, and then to each of your specific accounts. We then map these asset classes to the specific investments based upon the results of the analysis.

3.

We then optimize your portfolio by determining the appropriate asset classes for each category of accounts, and then to each of your specific accounts. We then map these asset classes to the specific investments based upon the results of the analysis.

What you are left with is a unique and customized investment portfolio that is tax-optimized and holistically efficient.

Learn More About our Other Wealth Tools

wm = ic + ap + rm

wealth management investment consulting

advanced planning

relationship management

Wealth Management Advisors, LLC DBA Everwealth®, located in Tulsa, OK, is a Registered Investment Adviser under the Oklahoma Uniform Securities Act of 2004. We provide wealth management and financial planning services. Past performance is not necessarily indicative of future results. Investing involves risk, including the possibility of financial loss. Insurance-related business is offered through Riddle Financial Group, LLC, a separate company from Wealth Management Advisors, LLC DBA Everwealth. Please see our Disclosure section for important information.