WEALTHEALTH™

See if you’re on the right track to achieve what it is you want to accomplish with your wealth.

Traditional forecasting and planning tools look at assumed static rates of return and simply subtract out expected withdrawals to measure whether or not you will be successful. With our proprietary wealthealth™ analysis, we take planning to the next level by defining what it is you want to accomplish, and optimizing the strategy to help accomplish it.

PLAN FOR YOUR WEALTH GOALS

Whether it’s a wedding for your daughter, college for your son, or simply an anticipation of retirement, Wealthealth™ considers each of the goals you want to accomplish so you can see how prepared you are.

PLAN FOR YOUR WEALTH GOALS

Whether it’s a wedding for your daughter, college for your son, or simply an anticipation of retirement, Wealthealth™ considers of the goals you want to accomplish so you can see how prepared you are.

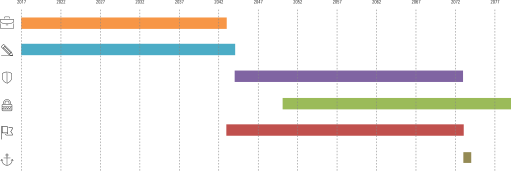

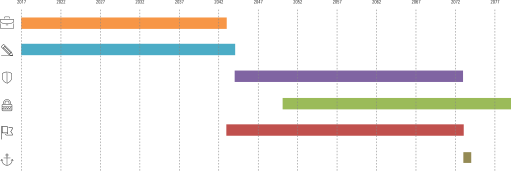

ACCOUNT FOR YOUR WEALTH EVENTS

Future expected income plays a strong part in a sound wealth management plan. Wealthealth™ accounts for these Wealth Events one-at-a-time, ensuring your plan is as detailed and customized as possible.

ACCOUNT FOR YOUR WEALTH EVENTS

Future expected income plays a strong factor in a sound Wealth Management Strategy. Wealthealth™ accounts for these Wealth Events one-at-a-time, allowing you to ensure your plan is as detailed and customized as possible.

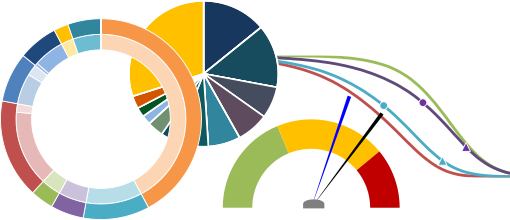

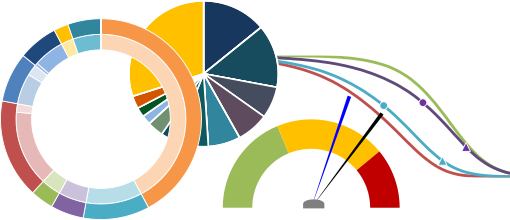

OPTIMIZE YOUR INVESTMENTS

Analyze all of your investment accounts and utilize your life expectancy to efficiently balance the appropriate target investment strategy for meeting your Wealth Goals while considering your unique risk characteristics.

OPTIMIZE YOUR INVESTMENTS

Analyze all of your investment accounts and utilize your life expectancy to efficiently balance the appropriate target investment strategy for meeting your Wealth Goals while considering your unique Risk Characteristics.

PROJECT YOUR RETIREMENT INCOME

Get a Projected Retirement Income level at various confidence thresholds. Then, balance it against your Desired Spending to see how prepared you are.

PROJECT YOUR RETIREMENT INCOME

Get a Projected Retirement Income level at various confidence thresholds. Then, balance it against your Desired Spending to see how prepared you are.

SEE YOUR WEALTHEALTH™

See a detailed final analysis breaking down the likelihood of you achieving success. Three tiers of Confidence Ranges benchmark your status, leaving the guesswork out of where you stand.

SEE YOUR WEALTHEALTH™

See a detailed final analysis breaking down the likelihood of you achieving success. Three tiers of Confidence Ranges benchmark your status, leaving the guesswork out of where you stand.

Learn More About our Other Wealth Tools

wm = ic + ap + rm

wealth management investment consulting

advanced planning

relationship management

918-524-6325

4200 East Skelly Drive

Suite 350

Tulsa, OK 74135

info@everwealth.net

Wealth Management Advisors, LLC DBA Everwealth®, located in Tulsa, OK, is a Registered Investment Adviser under the Oklahoma Uniform Securities Act of 2004. We provide wealth management and financial planning services. Past performance is not necessarily indicative of future results. Investing involves risk, including the possibility of financial loss. Insurance-related business is offered through Riddle Financial Group, LLC, a separate company from Wealth Management Advisors, LLC DBA Everwealth. Please see our Disclosure section for important information.